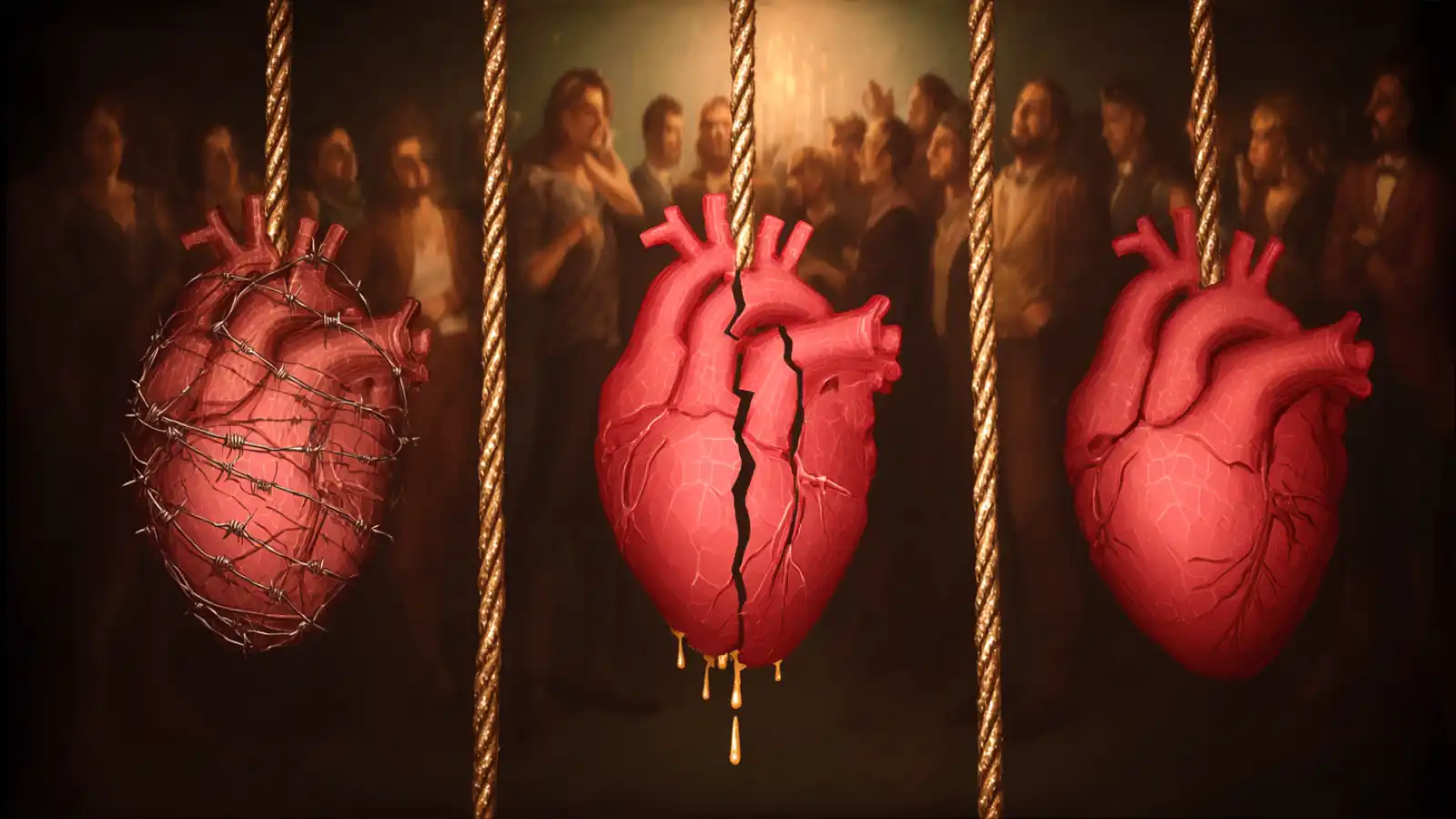

Your Money Trauma Scorecard: 3 Psychological Wounds That Keep You Broke

If you've ever felt broke no matter how much you earn, your real enemy might be invisible—and inherited.

The Hidden Score That Controls Your Bank Account

Your credit score isn't the only number that determines your financial future. There's another score – invisible, untracked, but infinitely more powerful. It's your Money Trauma Score, and it's been quietly sabotaging your wealth for years.

This isn't about budgeting harder or finding the perfect investment strategy. It's about the three core wounds that turn smart people into financial self-saboteurs. Money is the #1 stressor for Americans, yet we treat it like a math problem when it's actually a psychology problem.

Ready to calculate your real financial handicap? Let's expose the wounds that keep you poor.

Wound #1: The Scarcity Scar (Score: 0-10)

The Wound: You grew up hearing "we can't afford that" so often it became your internal soundtrack. Now, even with money in the bank, you feel perpetually broke.

How It Shows Up:

- You hoard resources like the Great Depression is coming back

- You feel guilty spending on anything beyond bare necessities

- You turn down opportunities because they feel "too expensive" (even when they're investments)

- You negotiate against yourself before anyone else gets the chance

Score Yourself:

- Do you check your bank account obsessively? (+2 points)

- Feel anxious when others spend freely? (+2 points)

- Avoid looking at investment opportunities? (+2 points)

- Think "must be nice" when you see wealth? (+2 points)

- Believe deep down that money is finite and scarce? (+2 points)

The Fix: Start small: Spend $20 on something purely enjoyable this week. Notice the world doesn't end. Your brain needs evidence that spending doesn't equal danger.

Wound #2: The Worthiness Wound (Score: 0-10)

The Wound: Somewhere along the line, you absorbed the message that people like you don't deserve wealth.

How It Shows Up:

- You undercharge for your work (or don't ask for raises)

- You give away money compulsively to "deserve" what you have

- Success feels uncomfortable, like wearing clothes that don't fit

- You sabotage windfalls with sudden "emergencies" or bad decisions

Score Yourself:

- Do you feel guilty when good financial things happen? (+2 points)

- Struggle to accept compliments about your work? (+2 points)

- Give discounts before anyone asks? (+2 points)

- Feel like an imposter when you earn well? (+2 points)

- Believe others deserve success more than you? (+2 points)

The Fix: List 10 times you created value for others. Read it daily. Your worthiness isn't up for debate – but your brain needs reminding.

Wound #3: The Rebel's Paradox (Score: 0-10)

The Wound: You want financial freedom, but success feels like betrayal. Building wealth means leaving your tribe behind.

How It Shows Up:

- You self-destruct right before big breakthroughs

- You hide financial wins from family/old friends

- You feel guilty for wanting more than your parents had

- You unconsciously recreate their struggles to stay "loyal"

Score Yourself:

- Do you downplay success around certain people? (+2 points)

- Feel anxious when you surpass family members financially? (+2 points)

- Hear their warnings in your head during opportunities? (+2 points)

- Create drama/crisis when things go too well? (+2 points)

- Feel like success means abandoning your roots? (+2 points)

The Fix: Write a letter to your family (don't send it) explaining that your success honors their struggles, not betrays them.

Your Total Money Trauma Score

0-10 Points: Minor scarring. Your wounds are healing. Focus on prevention.

11-20 Points: Moderate wounding. These patterns are actively limiting your wealth. Time for targeted healing.

21-30 Points: Severe trauma. Your financial potential is locked behind massive psychological barriers. Professional help recommended.

The Healing Protocol: Rewire or Stay Poor

Here's the uncomfortable truth: Your money trauma isn't your fault, but healing it is your responsibility – and your power. Your brain can be rewired, but it takes deliberate action.

Week 1: Exposure Therapy

- Look at your bank balance daily (even if it hurts)

- Write down every money fear that surfaces

- Ask yourself: "How were your parents with money, and how has that impacted you today?"

Week 2: Cognitive Rewiring

- Challenge each belief: "Is this coming from me, or is it just something I was taught?"

- Replace one limiting belief with its opposite

- Act on the new belief once (even small)

Week 3: Neural Pathway Building

- Celebrate one financial win daily (even $1 saved)

- Transform anxiety into curiosity about money

- Practice one new positive financial behavior

Week 4: Identity Reconstruction

- Surround yourself with people healing money trauma

- Actively rewrite your money narrative

- Make one bold financial move that the old you would've sabotaged

The Bottom Line: Scars or Freedom?

Your Money Trauma Score isn't a life sentence. These reactions were formed to protect you. But the protection has become a prison.

Every wealthy person had to heal these wounds. The only difference? They started.

Your wounds will either become your excuses or your fuel. The psychology of wealth isn't about positive thinking – it's about deliberate rewiring of trauma patterns that keep you poor.

Calculate your score. Face your wounds. Then decide: Will you heal them, or will they heal your bank account to zero?

The rebellion against your financial fate starts with this number. What's yours?

💡 "You're not bad with money. You're just wounded. But wounds can heal. And healed people build wealth."

Important Note: Severe money trauma may require professional support. Financial therapy is a growing field where certified professionals can guide you through exercises to heal money trauma. Your wealth depends on your wellness.

References

-

American Psychological Association. (2023). Stress in America 2023: A nation recovering from collective trauma. APA.

-

Klontz, B. (2023). Financial Psychology and Your Money Scripts. Financial Psychology Institute.

-

Northwestern Mutual. (2024). 2024 Planning & Progress Study. Northwestern Mutual.

-

Lutter, S. (2023). The Connection Between Childhood Money Experiences and Adult Financial Behaviors. Financial Therapy Association.

-

Journal of Financial Therapy. (2022). Money Scripts and Financial Behaviors: Understanding unconscious financial beliefs. Kansas State University.

-

Federal Reserve. (2023). Economic Well-Being of U.S. Households in 2022. Board of Governors of the Federal Reserve System.

We’re a group of passionate finance enthusiasts dedicated to making money management simple, actionable, and accessible for everyone.

Enjoyed this post?

Subscribe for more insights, tips, and updates—straight to your inbox.

We respect your privacy and will never share your information.