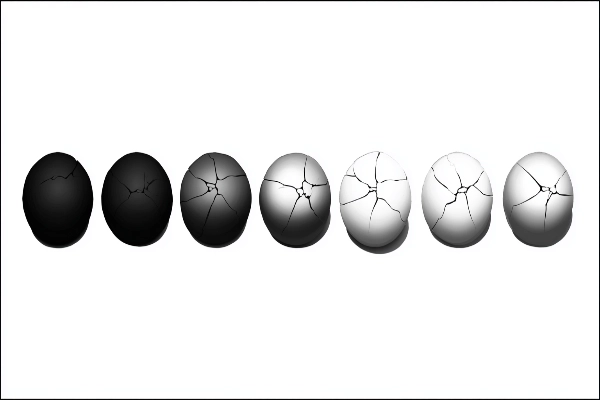

The 7 Shades of Freedom: Why Black-and-White Thinking Keeps You Broke

I used to think financial freedom was binary — you either had it or you didn't.

Then I watched a friend hit their "number" - enough invested to never work again - and somehow become more anxious than ever. They checked their portfolio like a heart monitor, showed up to work earlier, worried constantly about market crashes.

They were free on paper. But imprisoned in their head.

Turns out, they weren't alone. Less than one-third of millionaires actually feel wealthy. The rest are just well-paid prisoners.

The Shade That Blinds

Most people see financial freedom like pregnancy - you either are or you aren't. This binary bullshit is why 90% of people give up before they start. They look at the chasm between their current paycheck-to-paycheck existence and some mythical retirement number, and they think: Why bother?

But freedom isn't a destination. It's a spectrum. And once you see the shades, you can't unsee them.

Shade 1: The Survivalist

Living paycheck to paycheck. Tethered by fear and scarcity.

I've known people here. You probably do too. One flat tire. One missed shift. One copay away from disaster.

This isn't living — it's bracing. The system owns you, and every decision is just a slightly different flavor of panic.

The cruel irony? Survivalists often work the hardest. But hustle without leverage is just sophisticated slavery.

Shade 2: The Stabilizer

You've got an emergency fund. A debt plan. But the job still owns you.

That first $10K saved? It felt like a superpower. You start sleeping better. You make plans. You feel like you're winning.

But this is where the leash just gets longer. You're still one layoff away from fear.

Stability isn't freedom. It's just less panic.

Shade 3: The Optimizer

Budgeting religiously, investing wisely. Trapped in lifestyle creep.

This is where smart people get stuck forever. You've read every personal finance book. You max out your 401k. You can quote Warren Buffett. Your spreadsheets have spreadsheets.

But you've also "earned" that Tesla payment. The house in the good school district. The vacation to Santorini because "experiences matter more than things."

Optimizers are brilliant at making money and even better at spending it. Nearly half of six-figure earners live paycheck to paycheck - not because they can't save, but because they've optimized themselves into golden handcuffs so comfortable they forget they're still handcuffs.

Shade 4: The Explorer

Taking mini-retirements, building side income. Partial autonomy achieved.

The first time I took three months off to travel, my coworkers looked at me like I'd joined a cult. "Must be nice," they said, implying trust fund or lottery win.

Explorers have discovered the cheat code: You don't need full freedom to taste freedom. They've built enough runway to experiment. Sabbaticals. Passion projects. Saying no to overtime.

But they're still tethered to returning. The mini-retirement always ends. The side hustle hasn't replaced the main hustle. They're tourists in the land of freedom, not residents.

Shade 5: The Builder

Income flows from assets. Time-rich but not fully secure.

This is where things get weird. Your rental properties cover your basic expenses. Your dividend portfolio throws off spending money. You work because you want to, not because you have to.

But Builders live with a specific anxiety: What if it stops working?

They've built something beautiful but fragile. One bad tenant, one market correction, and they're back to trading time for money. They're free-ish, constantly looking over their shoulder.

Shade 6: The Controller

Complete work optionality. Tethered by identity and success addiction.

I've watched people reach this level - enough wealth to walk away forever - yet they can't stop. They tell themselves they're "building a legacy" when really they're just scared of who they'd be without the title.

Controllers have won the game but can't stop playing. One entrepreneur retired at 29 with enough to never work again. Six months later, he was back at his desk. "Making money was my only passion," he admitted. "Now that I have money, what's next?" The void nearly killed him.

Their identity is so wrapped up in achievement that freedom feels like failure. They could walk away tomorrow but won't because then who would they be?

This is the shade nobody warns you about - when money is no longer the prison, but your ego is.

Shade 7: The Liberator

Work by choice, mission-led. Tethered to nothing external.

I met a Liberator once. She ran a nonprofit teaching kids to code. When I asked about her "retirement," she laughed. "From what? This is what I'd do for free. Actually, I often do."

Liberators have transcended the entire framework. Money is a tool, not a master. Work is expression, not obligation. They've unlearned every lie about success, status, and security.

They're not retired. They're not grinding. They're just... free.

The Real Mind-Fuck

Here's what nobody tells you: You can feel freer at Shade 4 than Shade 6.

An Explorer who's designed their life intentionally experiences more day-to-day freedom than a Controller white-knuckling their identity. The number in your bank account matters less than the story in your head.

And that's the real trap - we chase the wrong checkpoints. We think we need Shade 7 to start living when Shade 3 could transform everything if we just recognized it.

The Real Prison

The tragedy isn't being at Shade 2 — it's living like you're there when you're actually at Shade 5. Psychologists call it 'money dysmorphia' - when millionaires check their accounts with the same panic as someone living paycheck to paycheck. Different numbers. Same fear.

I've met people with millions who still act like they're one bad week from ruin.

Your tether might be:

- The image you're afraid to let go of

- Scarcity trauma from childhood

- A career that became your identity

- Success momentum you can't stop

Until you name and cut your tether, you'll stay stuck — no matter how much you earn.

The Shift

Stop asking, "How much do I need?" Start asking, "What shade am I?"

Then ask the harder one: "What's still tethering me?"

Most people never make it past Shade 3. They budget perfectly while their soul withers. They invest in ETFs but never invest in possibility.

Don't optimize your prison. Design your escape.

You're not stuck. You're just unranked. And now that you see the game, you can start playing it differently.

The goal isn't reaching Shade 7. The goal is choosing the shade where you finally start living.

Financial freedom isn't about the number in your account—it's about the freedom in your mind. Start where you are, but start seeing clearly.

Related Posts

Financial Freedom Isn't About Quitting—It's About Control

Discover why financial independence is the only real freedom left in a system designed to keep you dependent. Learn how to reclaim control of your life through smart financial strategies.

When Money Becomes Irrelevant: The Ultimate Power Move

Discover the three levels of money and why true financial freedom happens when money stops being the constraint on your decisions.

Own Shit That Pays You: The Only Investment Advice You Need

Why building digital assets beats traditional investing and how the creator economy is rewriting the rules of wealth creation.

We’re a group of passionate finance enthusiasts dedicated to making money management simple, actionable, and accessible for everyone.

Enjoyed this post?

Subscribe for more insights, tips, and updates—straight to your inbox.

We respect your privacy and will never share your information.